south carolina inheritance tax 2021

Federal Estate Tax. Individual income tax rates range from 0 to a top rate of 7 on taxable income.

South Carolina Estate Tax Everything You Need To Know Smartasset

Download or Email st-3 More Fillable Forms Register and Subscribe Now.

. South Carolina Estate Tax 2021. STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE FIDUCIARY INCOME TAX RETURN SC1041 Rev. The federal gift tax has an annual exemption of 16000 per recipient.

For 2021 the credit is 07 of the lesser of 43333 or the South Carolina qualified earned income of the taxpayer with the lower qualified income for the taxable year. You would receive 950000. Heres how estate and inheritance taxes would work.

April 14 2021 by clickgiant South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away. The lawyers at King Law can help you plan for what happens after youre gone and were here to help you get a better sense of where you stand. 5421 3084 30841217 Name of estate or trust For the calendar year 2021 or.

February 24 2021 Janelle Fritts In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. In other words you can make up to 16000-worth gifts to as many people as you wish every year. As of 2021 33 states collected neither a state estate tax nor an inheritance.

We invite you to come in and talk with one of. On June 16 2021 the governor signed SF 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning January 1 2021. South Carolina has no estate tax for decedents dying on or after January 1 2005.

As of 2021 33 states collected neither a state estate tax nor an inheritance. Complete Edit or Print Tax Forms Instantly. South Carolina Property Tax Breaks for Retirees For homeowners 65 and older the.

A married couple can gift away up to 32000 to. Ad Access Tax Forms. Your federal taxable income is the starting point in determining your state income tax liability.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. The federal estate tax exemption is 117 million in 2021. For decedents dying in 2013 the figure was 5250000 and.

South carolina imposes a 542 tax on every gallon of liquor 108 on every gallon of wine and 77 cents on every gallon of beer. Ad Inheritance and Estate Planning Guidance With Simple Pricing. It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act.

In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. Twelve states and the. The top estate tax rate is 16 percent exemption threshold.

You would pay 95000 10 in. South Carolina Income Tax Calculator 2021 If you make 70000 a year living in the region of South Carolina USA you will be taxed 12409. Even though there is no South Carolina estate tax the federal estate tax might still apply to you.

The top estate tax rate is 16 percent exemption threshold. Your average tax rate is 1198 and your. In South Carolina the median property tax rate is 566 per 100000 of assessed home value.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. The estate would pay 50000 5 in estate taxes.

Ultimate Guide To Understanding South Carolina Property Taxes

Creating Racially And Economically Equitable Tax Policy In The South Itep

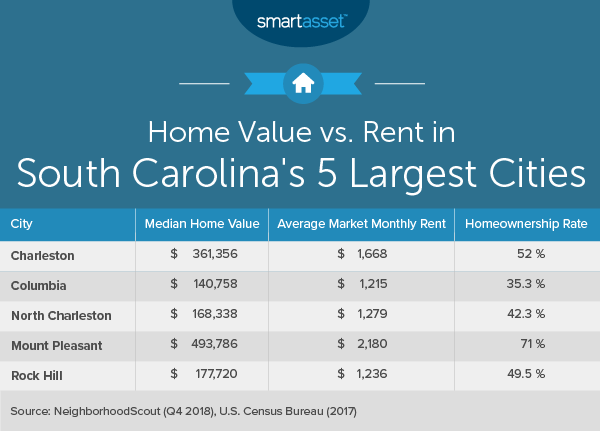

Cost Of Living In South Carolina Smartasset

South Carolina Inheritance Laws King Law

Real Estate Property Tax Data Charleston County Economic Development

South Carolina Sales Tax Small Business Guide Truic

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Small Towns Usa West Virginia

A Guide To South Carolina Inheritance Laws

South Carolina Income Tax Calculator Smartasset

South Carolina Lawmakers Reach Deal To Cut Income Tax

A Guide To South Carolina Inheritance Laws

South Carolina S 2021 Tax Free Weekend Kicks Off On Friday August 6

South Carolina Tax Rebates Are Coming To Eligible Taxpayers Who File Returns By October 17

The True Cost Of Living In South Carolina

Does South Carolina Require Inheritance Tax King Law

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation